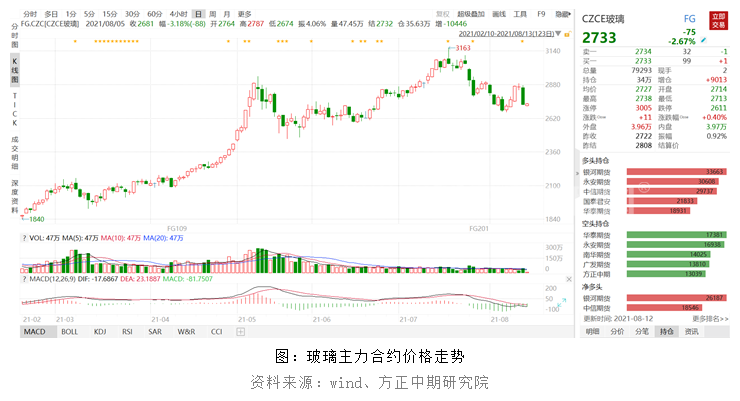

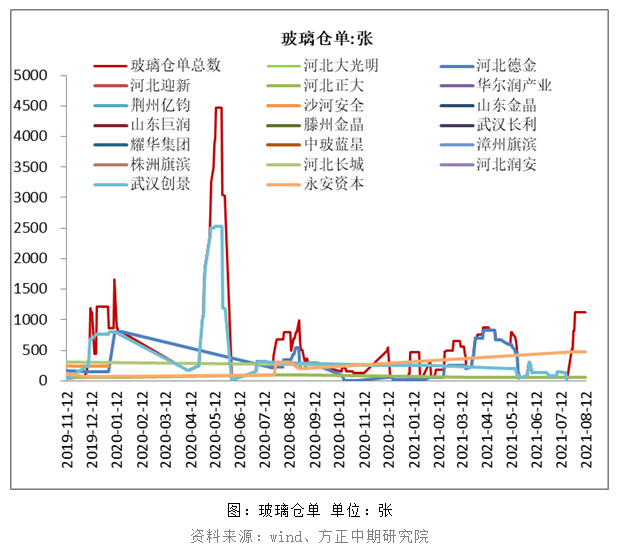

After the rainy season, the inventory of glass production enterprises has declined again from a historical low driven by the expectation of peak demand, and the spot price of glass has continued to rise significantly. In 2009, the contract once climbed to 3163 yuan, and the 2201 contract also broke the 3000 yuan mark twice. The continuous rise of glass futures market has driven the enthusiasm of glass production enterprises to sell hedging. The significant increase in registered glass warehouse receipts in mid July is closely related to the peak and decline of futures market. The continuous decline of the futures market from 3100 yuan has been influenced by the impact of the epidemic, and more importantly, the expectation of continued tight supply and demand has changed.

Data released at the beginning of last week showed that the current round of the epidemic has probably peaked, and the glass futures market has been greatly revised from previous expectations of the impact of the epidemic. The main 01 contract rose by over 4% last Tuesday. After short-term correction of expectations, the 01 contract once again returned to the main logic of a marginal slowdown in supply and demand tension, with high fluctuations in prices and production profits falling back. Data shows that the inventory accumulation of float glass enterprises accelerated last week. The total inventory of production enterprises in key monitoring provinces was 2010 million weight boxes, an increase of 2.28 million weight boxes or 12.79% compared to last week.

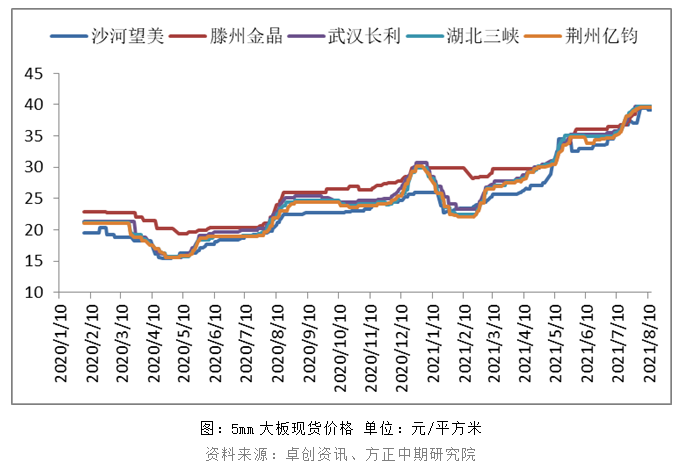

The high point of spot prices during the glass period is not necessarily or often does not appear in the golden nine silver ten. Traders are an important link in the glass industry chain. They provide a foundation for producers during the low demand season and incremental supply for society during the high demand season. Trader inventory is crucial for judging market trends, but there is a lack of authoritative statistics on the market. During the peak season of market demand each year, hidden inventory of glass in sectors such as traders and processors begins to be concentrated for shipment, and the actual transaction price trend of spot goods is not necessarily the peak season favorable price. This year's peak demand season has been hit by public health events, and the market should continue to be vigilant in the later stages.

1、 Glass Market and Its Logic

After the rainy season, the inventory of glass production enterprises has declined again from a historical low driven by the expectation of peak demand, and the spot price of glass has continued to rise significantly. In 2009, the contract once climbed to 3163 yuan, and the 2201 contract also broke the 3000 yuan mark twice. The continuous rise of glass futures market has driven the enthusiasm of glass production enterprises to sell hedging. The significant increase in registered glass warehouse receipts in mid July is closely related to the peak and decline of futures market.

2、 The recent supply and demand of glass are booming, and the long-term demand is declining

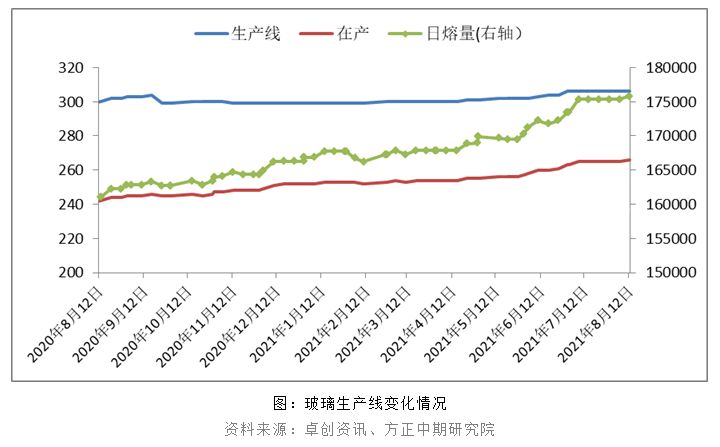

The continuous decline of the futures market from 3100 yuan has been influenced by the impact of the epidemic, and more importantly, the expectation of continued tight supply and demand has changed. In terms of supply, led by high profit levels, the production capacity of glass has maintained a stable increase trend. At the end of June, there were a total of 306 float glass production lines in China, with 263 in production and a daily melting capacity of 173425 tons, an increase of 10.71% year-on-year. As of the end of July, there were a total of 306 float glass production lines in China, with 265 in production and a daily melting capacity of 175325 tons, an increase of 1900 tons/day or 1.1% compared to the end of June, an increase of 8450 tons/day or 5.06% compared to the beginning of the year, and a year-on-year increase of 14880 tons/day or 9.27%.

As of the second week of August, there were a total of 306 float glass production lines in China, with 266 in production and a daily melting capacity of 175825 tons, an increase of 500 tons compared to last week. One production resumed within last week, and there are currently no cold repairs or production line changes. Tangshan Lanxin Glass Co., Ltd. completed the 500T/D first line cold repair and resumed production on August 8th.

In terms of demand, from January to June, the newly constructed area of housing was 1012.88 million square meters, an increase of 3.8%. The newly constructed residential area is 755.15 million square meters, an increase of 5.5%; From January to June, the land acquisition area of real estate development enterprises was 70.21 million square meters, a year-on-year decrease of 11.8%. According to data from Kerui, in July, the transaction area of commercial residential properties in 29 key monitored cities decreased by 12% year-on-year and 11% month on month, a decrease of 2% compared to the same period in 2019. The sales performance of the top 100 real estate companies in July was lower than that of the first half of the year and the same period in history. The weak trend on the demand side is gradually spreading from land acquisition and new construction to the sales side, and the demand for glass in the medium to long-term completed end will be significantly affected.

3、 Continuous accumulation of inventory in glass production enterprises

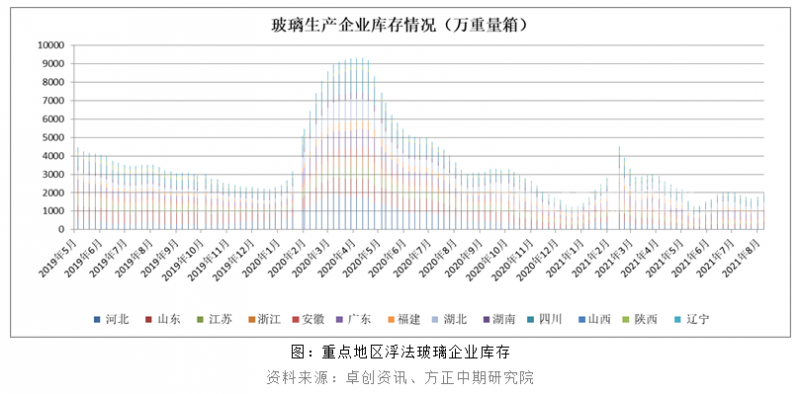

According to Zhuochuang Information, the total inventory of production enterprises in key monitored provinces last week was 20.1 million weight boxes, an increase of 2.28 million weight boxes or 12.79% compared to last week.

Last week, the inventory accumulation of float glass enterprises accelerated. On the one hand, public health incidents have led to restrictions on the distribution of raw materials in some areas, and factors such as power restrictions and weather have also had a certain impact on the demand side; On the other hand, the market has a strong wait-and-see atmosphere, coupled with prices still at high levels in most regions, and the enthusiasm for stocking in the middle and lower reaches is not high. Therefore, we are waiting for more favorable prices. From a regional perspective, there is a significant difference in shipments in the North China region, with a low production and sales rate in Shahe. The inventory of manufacturers has increased to about 1.8 million weight boxes, and the inventory of traders has remained basically stable. The shipment in the Beijing Tianjin Tang region is stable, and inventory remains low; Transportation is still limited in some regions of East China, with most factories in Shandong, Anhui, and Zhejiang experiencing a decrease in outbound shipments and significant inventory increases. The production and sales performance in Jiangsu Province is still good, with some factories experiencing a slight decrease in inventory; The investment in Central China is poor, and the inventory of manufacturers has increased to varying degrees, while most are still controllable. Local shipments have slightly improved near the end of last week; The South China region is mainly affected by rainy weather and market wait-and-see atmosphere, with some areas experiencing significant impact due to restrictions. Overall, the production and sales of enterprises were flat last week; The shipment in Northeast China slowed down slightly last week, with some factories experiencing a slight increase in inventory and still at a low level; The production and sales in the southwest region are basically balanced, with little inventory change. The Yungui region has good shipments and basically no inventory.

Extremely low inventory leads to an extreme upward trend in the market, and after the inventory of production enterprises rebounds, high prices and high profits are difficult to sustain. The current trend is logical.

4、 Prospects for Glass Aftermarket Trading Opportunities

With the accelerated release of demand for completed real estate projects, the tight supply and demand situation for glass will continue in the second half of the year; In the long run, sustained and stable growth on the supply side is the decisive factor in the market. Recently, one of the main transfer destinations, Henan, has experienced a period of sluggish demand and poor external transportation in the Shahe region, which has to some extent hindered the market. Overall, this is a top and worth exploring.

After the short-term correction of the impact of the epidemic on the market, the 01 contract once again returned to the marginal slowdown of supply and demand tension, with the main logic of high fluctuations in prices and production profits falling back.

The high point of spot prices during the glass period is not necessarily or often does not appear in the golden nine silver ten. Traders are an important link in the glass industry chain. They provide a foundation for producers during the low demand season and incremental supply for society during the high demand season. Trader inventory is crucial for judging market trends, but there is a lack of authoritative statistics on the market. During the peak season of market demand each year, hidden inventory of glass in sectors such as traders and processors begins to be concentrated for shipment, and the actual transaction price trend of spot goods is not necessarily the peak season favorable price. This year's peak demand season has been hit by public health events, and the market should continue to be vigilant in the later stages.

(1) Short selling 01 contract on high

Glass Futures January Contract

(2) Cross period arbitrage: Long 09 Short 01

Analysis of the 1-9 price difference trend of glass futures

Risk points that need to be paid attention to in the later stage: completion demand exceeding expectations, production enterprise inventory returning to extremely low levels, etc.